I recently finished reading Rich Dad Poor Dad by Robert T. Kiyosaki. This book offers a very insightful approach to managing wealth so that one can achieve financial freedom. Although it doesn’t go into great detail into the specifics of investing, entrepreneurship, or running a business, Rich Dad Poor Dad does provide a strong foundation for financial literacy. I found this book very enlightening and it has shaped the way I look at my personal wealth and make financial decisions.

Kiyosaki named the book Rich Dad Poor Dad because the book revolves around lessons he learned from the two most influential mentors of his life, his biological father (Poor Dad), and his friend Mike’s father (Rich Dad). Even though Poor Dad was highly educated, had a Ph.D. and held degrees from Stanford University, the University of Chicago, and Northwestern University, he consistently struggled financially. Rich Dad, on the other hand, never finished the eight grade, but he still ran multiple successful businesses and was, according to Kiyosaki, “one of the richest men in Hawaii”. Rich Dad, Kiyosaki writes, “died leaving tens of millions of dollars to his family, charities, and his church” while Poor Dad “left bills to be paid when he died”.

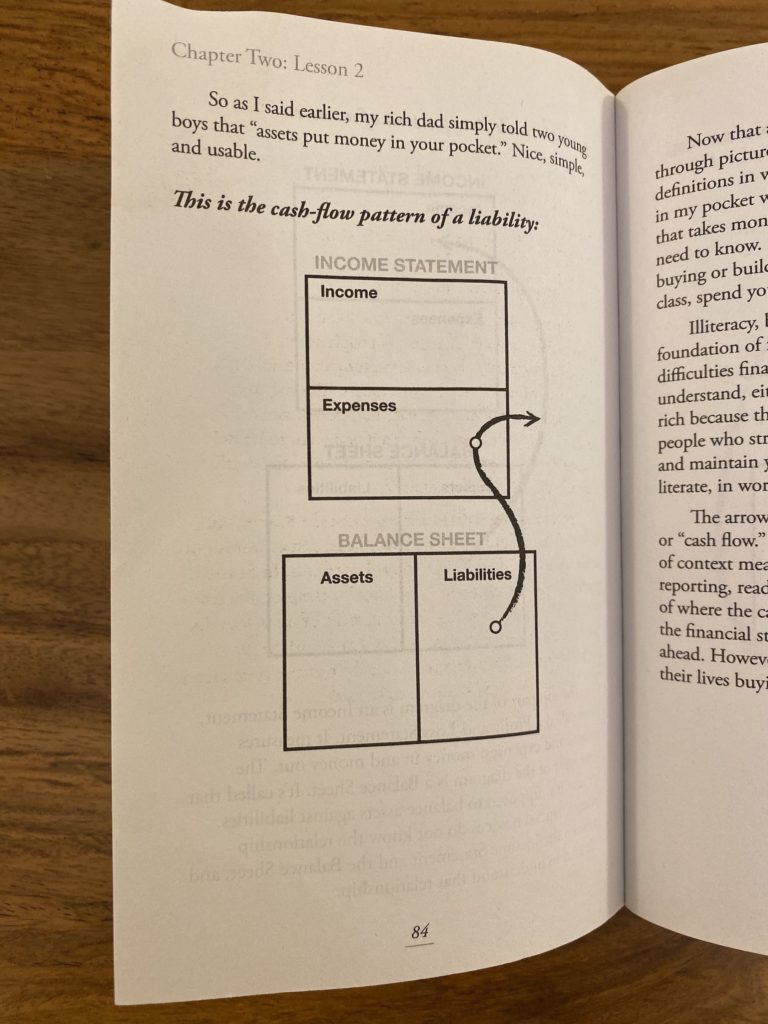

The difference in fate was a result of the two profoundly different ways Rich Dad and Poor Dad looked at money. Poor Dad, like the great majority of the population, exchanged his labor for money. The problem with this approach is that a person becomes a slave to his job if it is his primary source of income. He enters a “pattern of get up, go to work, pay bills; get up, go to work, pay bills”, which Kiyosaki calls the “Rat Race”. He has no choice but continue to stay in this cycle because his livelihood stems from his job. After he retires, he has to make sure he has enough money to last until he dies. Not a very nice life.

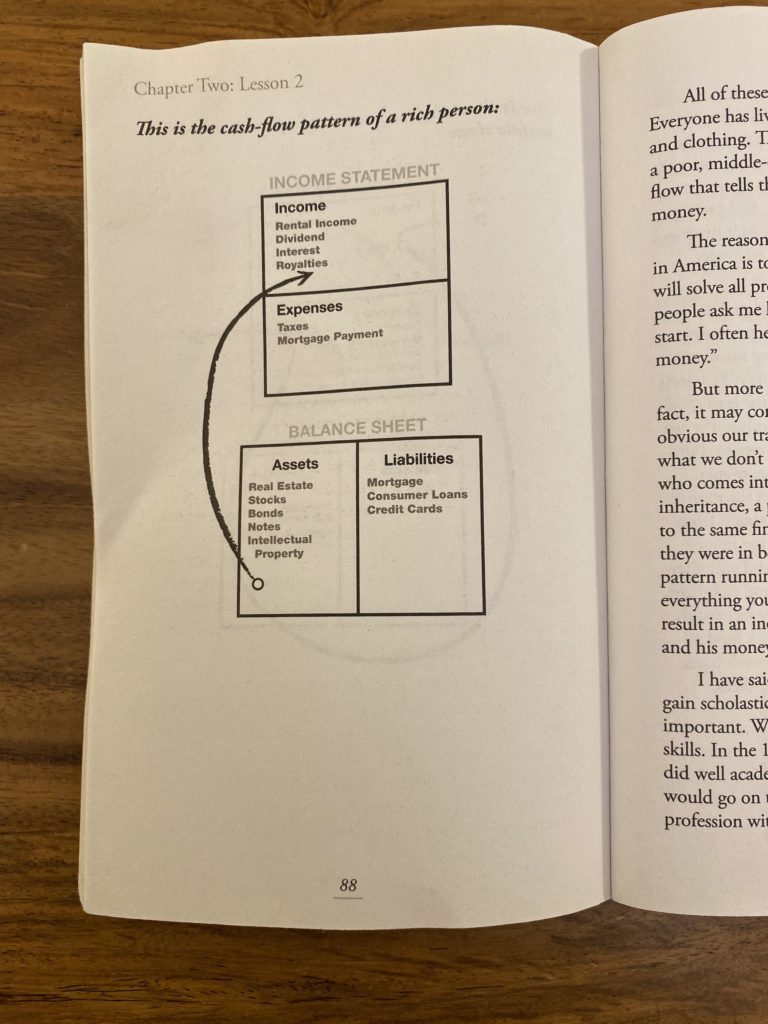

Rich Dad, on the other hand, owned multiple businesses and derived his income from their profits. Although Rich Dad came from a poor background, he focused on building his own businesses and reinvested his profits into cash-generating assets (his businesses, stocks, real estate, etc.). Because Rich Dad hired talented people to run his businesses, he gets to decide his own schedule. Of course, if he has a vision for his business or wants to start a new one, Rich Dad would be actively involved, but since his assets would be generating cash whether he is working or not (which is called passive income), Rich Dad’s approach provides true financial freedom.

As Kiyosaki puts it, “The poor and the middle class work for money. The rich have money work for them.”

Rich Dad’s advantage is not just that he isn’t tied down to a job for his livelihood and has the freedom to do other things, but also that the vast majority of wealth generation in the economy comes from business profits and capital gains. You can only reap this wealth if you have ownership of the assets that experience profit-making and capital gains, and most people do not. Most people, like Poor Dad, derive income by giving their labor, and labor is simply one of the many expenses a business makes. The wealthy make money when the businesses they own make money, while everyone else make money when the businesses they work for spend money. For any economy to be sustainable, businesses, on the aggregate, must make more than they spend, so consequently the wealthy will receive greater income. Moreover, there usually are far fewer people owning businesses than there are people working for those businesses, so there is a bigger share for owners to take home. To add on top of that, tax laws in the United States, and in many other countries, favor business owners and investors over salary earners. Corporation laws, lower corporate taxes, and lower capital gains taxes allow the wealthy to pay less to the government than salary earners.

Kiyosaki dedicates a whole chapter to taxes and understanding the corporation, which he calls “the biggest secret of the rich”. One of the most popular ways intelligent businessmen pay less in taxes is through the use of corporations. Because corporations are allowed to pay expenses before paying taxes, they can dramatically reduce the amount of taxes paid. As Kiyosaki puts it, “A corporation earns, spends everything it can, and is taxed on anything that is left”. Employees on the other hand, must pay taxes before they are allowed to spend what they have left. Those who own their own corporation are able to spend pre-tax dollars that employees cannot. For example, “vacations can be board meetings in Hawaii. Car payments, insurance, repairs, and health-club memberships are company expenses. Most restaurant meals are partial expenses, and on and on”.

A major reason emphasized in the book on why it is important for people to acquire assets is because a job is a short-term solution to a long-term problem. One does not have a job indefinitely. The job can become redundant, the person could get fired, the business might fail, and eventually people need to retire and make sure they saved enough to die before they go bankrupt.

Assets on the other hand can appreciate and generate cash flow whether or not someone is working. Of course assets sometimes lose value or even default, but it is much easier to acquire multiple assets to reduce risk than it is to work multiple jobs. If you have the cash, you can start buying stocks right now and build your assets. Income derived from assets is a long-term solution to a long-term problem.

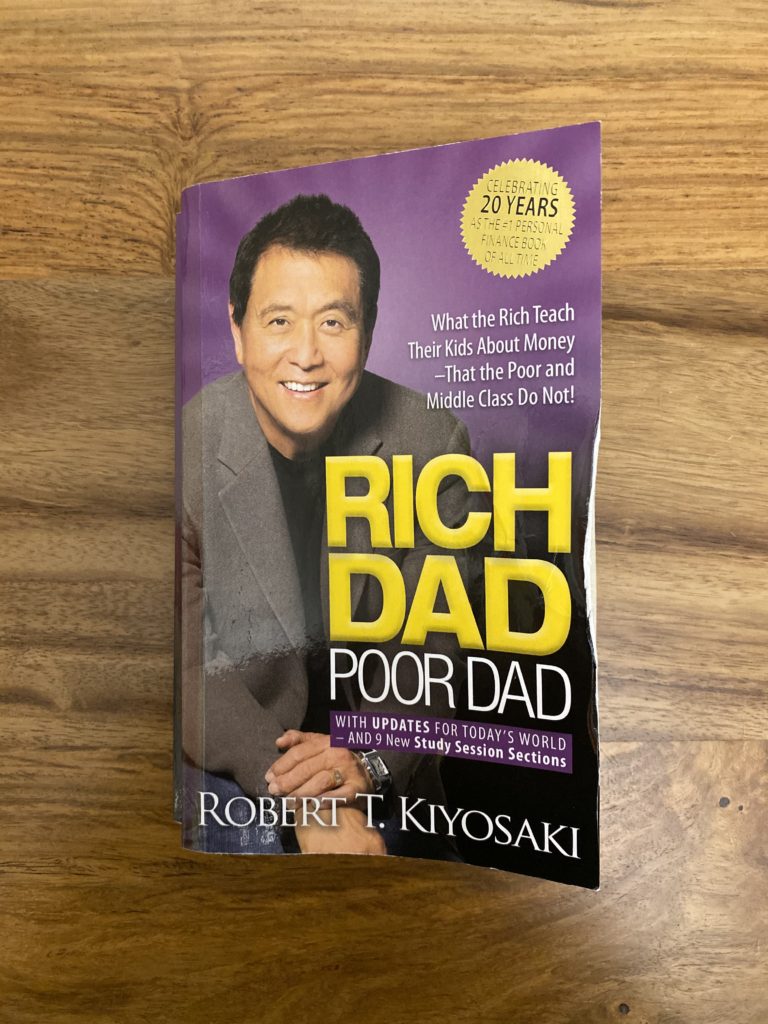

Now that the importance of acquiring assets has been established, it is necessary to define what is an asset, and what is not. Kiyosaki provides a simple but useful definition for an asset: an asset is something that puts money in your pocket. In other words, assets add to your income by either generating cash or appreciating in value. Examples of assets include businesses, stocks, bonds, real estate, and intellectual property.

Assets add to your income

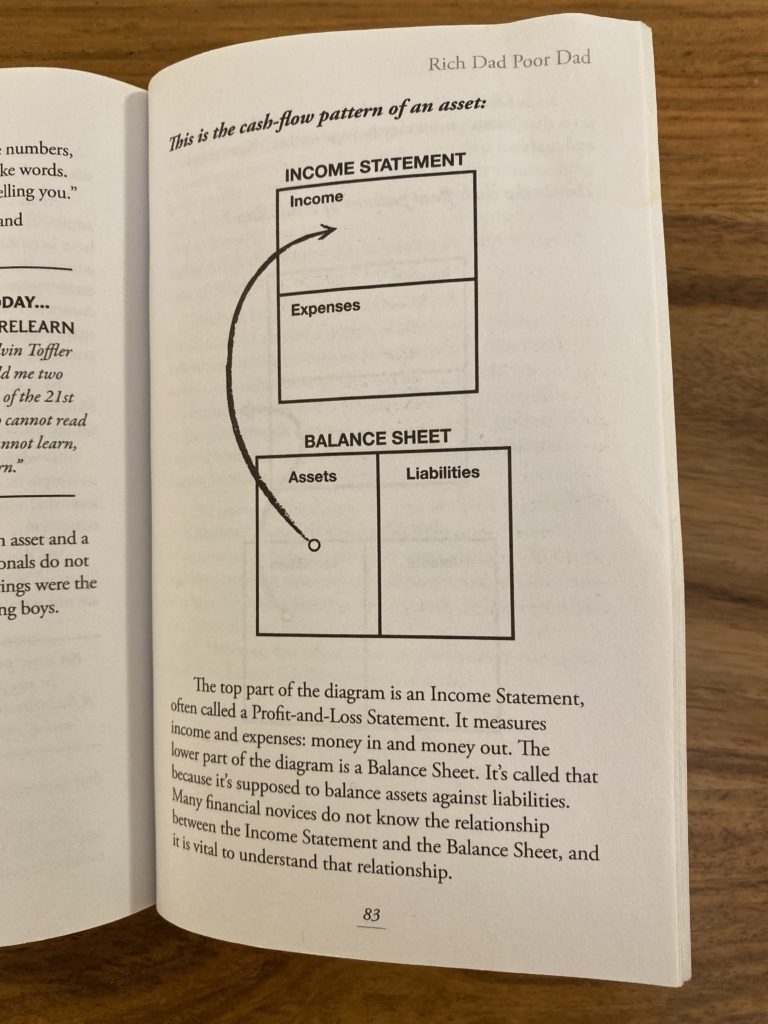

It is also important to understand what a liability is. To use Kiyosaki’s definition, liabilities take money out of your pocket.

Liabilities take money out of your pocket

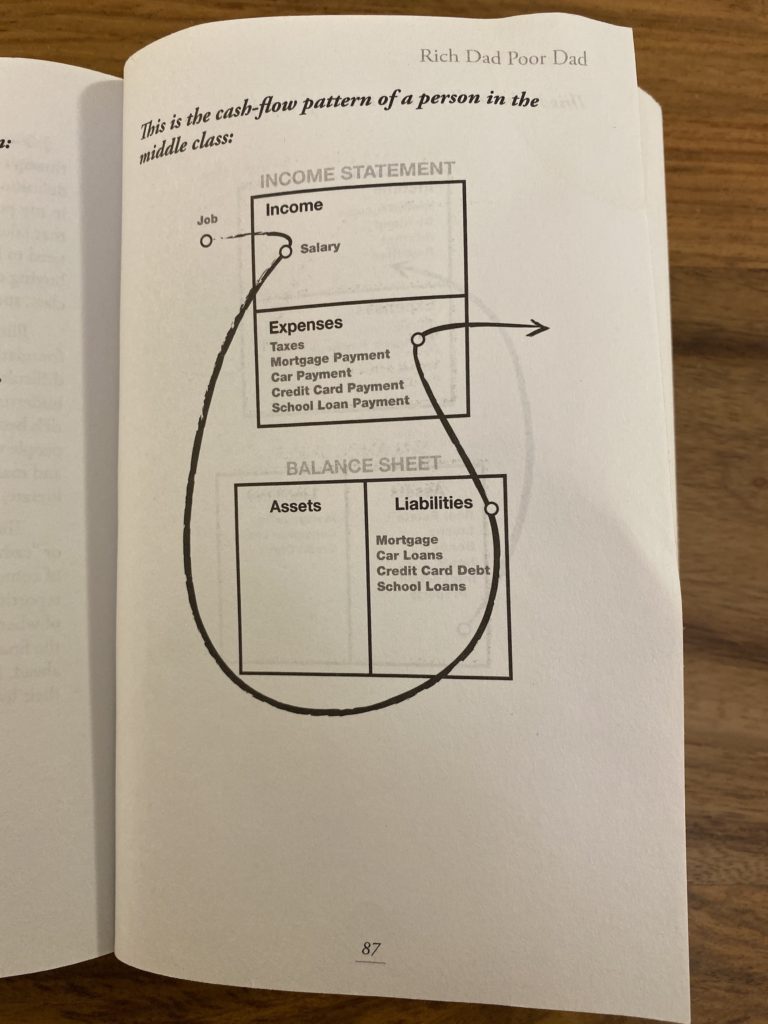

Thus, the key to financial wealth is to acquire assets and avoid liabilities. Sounds simple but unfortunately many people fail at this. Here are some simplified diagrams from the book illustrating the cash flow patterns of a poor person, a person in the middle class, and a rich person, respectively.

What keeps many people in the middle class is the acquisition of liabilities such as mortgages, credit card debt, and loans, rather than assets such as real estate, stocks, bonds, notes, and intellectual property. Since liabilities take money out of your pocket, people in the middle class would have to fund their liabilities as well as pay for their expenses before they can even consider acquiring assets. This goes back to the trap that Kiyosaki calls the “Rat Race”: the middle class have to work hard at their jobs to pay down their loans and other liabilities, and don’t get the chance to acquire assets that would lead to financial freedom.

One interesting point Kiyosaki makes is that a house is not an asset. Although by convention accountants consider a house an asset, Kiyosaki does not because it takes money out of homeowners through mortgage payments, property taxes, insurance, maintenance, and/or utility bills. I agree with Kiyosaki and I think that although owning a house is great, the homeowner should not fool himself to believe that his house is an investment, especially because there are a plethora of other investment vehicles that do not require a constant draining of cash for upkeep.

Most of the information above can be found in the first half of Rich Dad Poor Dad. I found the last few chapters of the book less useful because it mainly consisted of repetition of previously mentioned concepts, Kiyosaki attempting to sell his other books and products, and Kiyosaki sharing his personal real estate success stories that were vague in detail and seemed highly unrealistic.

The only new concept I thought was useful from the last few chapters of the book was the importance of investing in yourself. Fortunes come and go, but knowledge stays with you for the rest of your life. Knowledge is power and it is what allows people to gain and maintain fortunes. Continually learning throughout your life empowers you to expand your capabilities and your potential.

Some of you might be thinking, “This sounds great but I’m not rich and can’t acquire assets”. Remember that Rich Dad himself rose from a poor background, and many others did the same. In fact, a 2017 study by Fidelity Investments found that 88% of millionaires are self-made, while the 2019 Wealth-X Billionaire Census found that 55.8% of billionaires are self-made.

Acquiring assets isn’t as inaccessible as many would think. Setting up a stock brokerage account is pretty straightforward, and the majority of stocks trade at a few dollars, to tens of dollars, to hundreds of dollars, all prices that are accessible to ordinary people. Even buying real estate nowadays has become easier through REITs (Real Estate Investment Trusts), which are often publicly traded. You can also buy bonds and notes to further build your asset column. Bonds and notes may not be able to generate the high returns one can get from stocks and real estate, but they are usually safer and less likely to result in big losses.

You don’t have to buy assets, you can also build them. Starting a business, inventing patented technology, making music, writing books and articles, filming movies and videos, etc. are all ways to build assets that can generate cash for you in the future. In today’s digital age, creatives have access to a worldwide market and can receive royalties for the work they produce. Additionally, with the rise of social media and the influencer economy, anyone can start building an online presence that they can monetize, whether it is through ad revenue sharing on YouTube, sponsored posts on Instagram, or monetized articles on Medium (like this one).

Whether you’re going to buy your assets or build them, being a lifelong learner is important, whether you want to be a better investor, a better entrepreneur, or a better creative. Rich Dad Poor Dad provides a very strong and easy to understand introduction to financial literacy. Even for someone like me, who started investing since freshman year of college and has been learning about finance from an early age, Rich Dad Poor Dad has had a profound effect on my thinking. I am very glad I picked up this book.

If you want to read Rich Dad Poor Dad yourself, here’s a link to order it on Amazon.

Rich Dad Poor Dad: https://amzn.to/2LaYREb

——

Disclosure: As an Amazon Associate I earn from qualifying purchases.